Structure Tomorrow's Success: Just how to Save for College Expenditures

Building a Solid Financial Foundation for University: Top Approaches for Smart Preparation

As the cost of university continues to increase, it has become significantly vital for pupils and their households to construct a strong economic foundation for their higher education and learning. In this conversation, we will check out the leading strategies for wise economic planning for college, consisting of setting clear goals, understanding university costs, creating a budget plan and cost savings plan, exploring gives and scholarships, and thinking about pupil finance options.

Establishing Clear Financial Goals

Establishing clear economic goals is a necessary action in effective financial preparation for university. As pupils prepare to get started on their higher education journey, it is vital that they have a clear understanding of their economic purposes and the actions called for to achieve them.

The first aspect of setting clear monetary goals is defining the expense of university. This includes researching the tuition charges, holiday accommodation expenses, books, and other assorted expenses. By having an extensive understanding of the monetary requirements, trainees can set achievable and reasonable objectives.

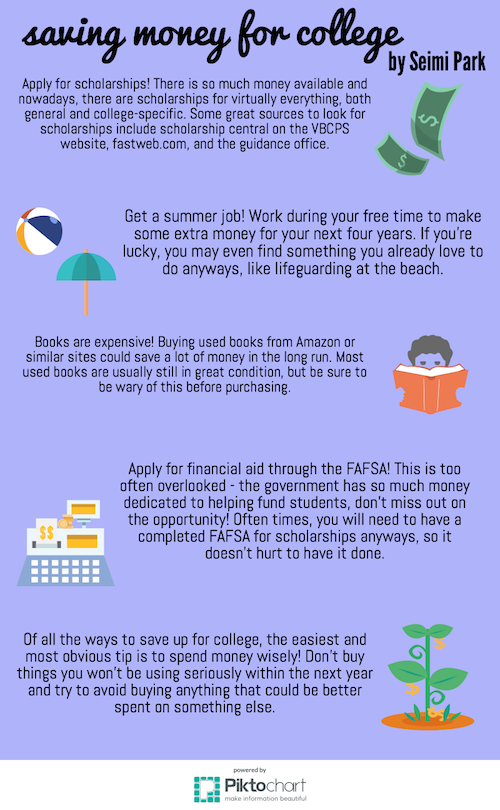

Once the expense of university has actually been identified, students need to establish a budget. This includes examining their earnings, including scholarships, gives, part-time jobs, and parental payments, and afterwards allocating funds for necessary expenditures such as housing, tuition, and food. Producing a budget aids pupils prioritize their investing and makes certain that they are not overspending or building up unneeded debt.

Furthermore, setting clear financial objectives likewise involves recognizing the requirement for savings. Pupils must identify just how much they require to save every month to cover future costs or emergencies. By establishing a savings goal, students can establish healthy economic practices and plan for unanticipated situations.

Recognizing College Prices

Recognizing these expenses is important for efficient monetary planning. It is important for pupils and their family members to completely research study and understand these costs to develop a sensible budget plan and financial strategy for university. By comprehending the various parts of college prices, individuals can make informed choices and prevent unneeded economic anxiety.

Producing a Budget and Financial Savings Plan

Producing a thorough spending plan and savings strategy is crucial for reliable economic planning throughout university. Begin by providing all your resources of earnings, such as part-time jobs, scholarships, or financial help. It calls for constant tracking and adjustment to ensure your economic security throughout your college years.

Exploring Scholarships and Grants

To optimize your funds for college, it is crucial to discover readily available scholarships and grants. Save for College. Gives and scholarships are a wonderful means to finance your education without needing to rely heavily on finances or personal financial savings. These financial assistances are usually granted based upon a variety of variables, such as scholastic success, athletic efficiency, extracurricular participation, or monetary requirement

Start by researching grants and scholarships provided by colleges and colleges you are interested in. Numerous their website organizations have their very own scholarship programs, which can provide considerable monetary aid.

When applying for grants and scholarships, it is important to pay very close attention to due dates and application needs. The majority of scholarships require a completed application type, an essay, recommendation letters, and records. Save for College. Ensure to adhere to all guidelines carefully and submit your application ahead of the due date to boost your possibilities of obtaining financing

Checking Out Pupil Financing Options

When thinking about how to fund your college education, it is very important to check out the numerous choices available for pupil fundings. Student financings are a typical and convenient method for students to cover the expenses of their education and learning. Nevertheless, it is crucial to comprehend the different types of pupil fundings and their terms prior to deciding.

One more option is private pupil financings, which are given by financial institutions, lending institution, and various other personal lenders. These loans often have greater rate of interest rates and extra rigid payment terms than federal loans. If federal loans do not cover the complete cost of tuition and various other expenses., exclusive car loans may be needed.

Conclusion

In conclusion, building a strong economic foundation for university requires setting clear objectives, recognizing the prices entailed, developing a spending useful source plan and financial savings strategy, and checking out scholarship and give chances. It is important to think about all offered options, including student loans, while minimizing individual pronouns in a scholastic composing style. By following these approaches for clever preparation, trainees can navigate the economic elements of college and lead the way for a successful scholastic journey.

As the cost of university proceeds to rise, it has actually come to be progressively essential for students and their family members to develop a solid economic structure for their higher education and learning. In this discussion, we will discover the top strategies for clever monetary preparation for college, including establishing clear goals, recognizing college prices, producing a budget and financial savings plan, discovering gives and scholarships, and thinking about student financing choices. It is important for look at this website trainees and their families to completely research and comprehend these costs to produce a realistic budget plan and economic plan for university. These monetary help are generally granted based on a variety of aspects, such as academic accomplishment, sports performance, extracurricular involvement, or economic need.

By complying with these strategies for wise preparation, pupils can navigate the monetary facets of college and pave the method for an effective academic journey.